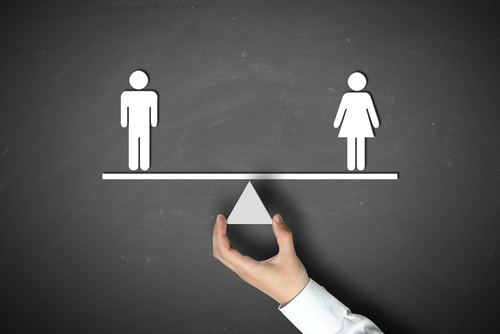

The UK may be the fastest growing start-up nation in Europe, but men are still twice as likely to be entrepreneurs than women, with just 5.6 per cent of UK females running their own business.

As a result, women continue to face hurdles in the venture capital and crowdfunding sector – where early financing is made available to start-ups and small businesses – not least because of the outdated notion that men are a ‘safer bet’.

In fact, for every £1 of VC-investment in 2018, all-female founder teams received less than a paltry 1p, while all-male founder teams received an overwhelming 89p. But it would be unfair to lay the blame completely on male unconscious bias. Rather, we need to recognise that society – men and women alike – has cultivated a general misconception that ‘female designated’ traits and skills such as intuition or empathy are not required to build a successful business.

There is also the added issue that female founders tend to be younger than their male counterparts, which raises the question of family commitments – much more so than it should. The fact that the average entrepreneur is a white male in his forties suggests that venture capitalists do not always see mothers as having the potential to be successful entrepreneurs. However, it is an insulting assumption that women cannot have children and run their own business. Fathers also have familial responsibilities, but their commitment and ability to succeed is rarely questioned.

There are many life events that also require young men to focus on something other than work, and it is important that investors understand that being single-mindedly consumed by work is not healthy for the individual nor his or her business. Ultimately, the definition of a good business leader should be the same regardless of gender. Investors, whether male or female, need to consider the criteria they use to judge a business venture very carefully. It is not about which entrepreneur appears ‘more hungry’ or spends more time working; it must come down to talent and effectiveness.

Changing the dynamics

While we cannot banish unconscious bias altogether, being alive to it can make a huge difference. We need to gather a mass of new investors who understand the additional issues female founders face and spend more time analysing their own decision-making process, creating an environment that females can trust and to which they can relate.

For some male investors, it may be a case of ‘better the devil you know’, without it ever occurring to them how difficult it may be for women to raise capital or have the same impact as their male counterparts. Yet, closing the gap between male and female entrepreneurs could generate as much as £250 billion for the UK economy.

We must therefore work together to replace traditional institutional decision-makers and promote a more diverse and thoughtful consideration of the process. For example, encouraging venture capital firms to employ female analysts, who will eventually be responsible for choosing investment opportunities, would help to level out the playing field considerably.

It is clear that the main issue affecting female entrepreneurs is how society perceives women and what we believe them to be good and bad at. We must not become guilty of simply paying lip service to encouraging more women to start their own businesses; we all need to make a concerted effort to change our thinking. Until then, we will have a system that represents just one point of view, ultimately leading to a less diverse, less exciting and less inspiring investment landscape for us all.

About the author

About the author

Philippa Sturt is the Managing Partner at Joelson. She specialises in corporate and commercial transactional matters of all kinds. Her main areas of practice include growth capital fundraisings and start-ups, acquisitions and disposals, company reorganisations, shareholder matters and commercial agreements.

She acts for numerous founders and early stage businesses. In particular, she has acted for a number of start-up businesses in the health and wellness, food and beverage and FMCG sectors.