Article by Laura Dallas, Head of Product at Champion Health

I know this to be true, because the Champion Health team and I recently explored the effects of the cost of living crisis in our latest report: Cost of Living Crisis: Financial Stress and Employee Wellbeing.

We analysed anonymous health data from over 2,200 professionals across a range of demographics and sectors. Our aim: to understand how financial stress impacts employee wellbeing and performance.

In creating this report, we uncovered a number of insights into how financial stress is intrinsically linked to both physical and mental health. And one area which quickly drew my attention was how these effects varied across different demographics within the workforce.

In this article, we’re going to explore three key insights from the report. This includes how financial stress is affecting our mental health, female employees like me, and the young workforce.

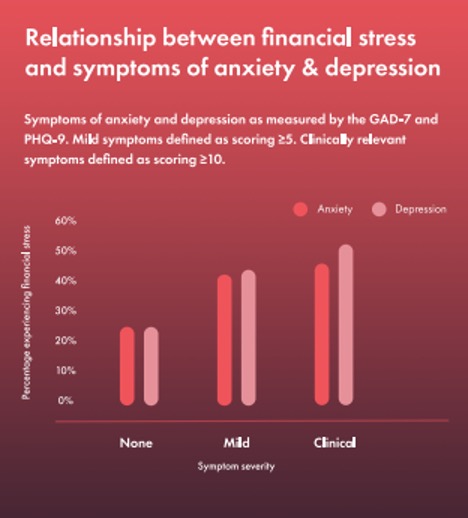

Our research revealed that symptoms of anxiety and depression are correlated with higher levels of financial stress. Put simply: as symptoms of anxiety and depression became more severe, financial stress became more prevalent.

We also discovered a clear link between money and mental health: better mental health is associated with a healthier relationship with money. This means that organisations need to take steps to support both the financial and mental wellbeing of their employees.

A great place to start is opening up the financial wellbeing conversation in your organisation.

Like mental health, conversations around money are often stigmatised, preventing many employees from seeking the help they need. But to better identify and support struggling colleagues, you need to reverse this trend.

Simple actions, like making sure every employee is aware of the financial wellbeing support you offer or raising financial wellbeing in staff appraisals, will make a huge difference.

By normalising the conversation around money and prioritising the financial wellbeing of your team – you can support your colleagues at a time when they really need it.

As mentioned above, the cost of living crisis does not affect everyone equally. Our research revealed that female professionals are 33% more likely to experience financial stress, compared to their male counterparts.

While there may be many reasons for this, these findings take on added significance in the context of the well-researched gender gap in financial wellbeing. Research by the likes of Aon and JP Morgan finds that this gap exists within key indicators of financial wellbeing – such as pensions, income and financial engagement.

These results highlight the need to prioritise diversity and inclusion within organisational approaches to financial wellbeing, as it is unlikely any wellbeing strategy will be effective without it.

Younger employees are struggling with the cost of living crisis. Our data reveals that employees between the ages of 25-34 are more likely to experience financial stress compared to their older counterparts.

On a more positive note, recent research by Aviva shows that younger employees are also more likely to seek and engage with financial wellbeing support.

This means that younger employees are a demographic in which employers can generate significant impact with their financial wellbeing initiatives.

Financial wellbeing disparities are being exacerbated by the cost of living crisis. Our research highlights the need for employers to provide inclusive support that bridges the financial wellbeing gap between different demographics of the workforce.

To address these issues, employers must recognise the varied pressures faced by different demographics. To discover these, I encourage organisations to gather information on your employees’ current financial wellbeing – either through wellbeing platforms or internal surveys.

Once you have discovered the areas of your business where financial wellbeing support will be most impactful – tailor your financial provisions accordingly. In this instance, our data makes a convincing case for additional financial wellbeing support for female employees and younger employees.

If you’re looking for further ideas and ways of integrating financial wellbeing into your workplace health strategy, check out the report.

Laura has worked in a number of mental health settings across her career, from front-line NHS services to academic research facilities. As Head of Product at Champion Health, she is now responsible for ensuring Champion’s platform drives market-leading engagement with wellbeing.