I advise thousands of businesses getting ready to start, scale and seek investment right up until they exit or sell . It is never easy and there are always ups and downs, but the market is vibrant right now; investors are keen to enter the UK market and female founders are seeing more active interest than ever before.

The Alison Rose Review of Female Entrepreneurship published in March 2019, highlighted that up to £250 billion of new value could be added to the UK economy if women started and scaled up new businesses at the same rate as men

Fundraising for many businesses is vital so being prepared is likewise the key. No more so than for start-up technology companies who burn through a considerable amount of money, especially when pre-revenue. This article examines some of the key legal considerations when trying to raise capital for your business.

Over the years we have seen many different businesses turn to equity financing without exploring the different options which may be available. For many it is seen as the easy option, but this is not necessarily the case. With equity financing you are giving away a share in your business and welcoming in a new stakeholder who has legal rights and to whom you owe legal responsibilities.

Founders often neglect to explore other financing options, which can be used simultaneously or as an alternative : such as debt financing ( where you do not give up a share of your business) these can be with high street or commercial lenders which are displaying commercial rates presently or maybe you qualify for grants (essentially free money) as the UK offers many. Businesses should also consider whether there is R&D relief available which can result in a cash payment based on funds you have spent on R&D. In addition founders should explore whether there is any Covid-19 support available to them or low interest debt options.

Founders should be mindful that equity is not the only possibility and may not be the best fit for their business. We hear often ‘women calculate to the last pound so are meticulous , but they never ask for enough’ . This means banks may like the clear accounts and be more favourable or investors thinking its not a big enough investment for them. It’s a juggling act depending on who the pitch/proposal goes to. Backing up the request is essential, but asking for more than you need for plan B can also been seen as more attractive and understood practice and founders are reminded to push forward.

It is important that you look carefully at your business and company from the perspective of any potential investor. As part of any investment process you can expect a degree of due diligence. This often takes the form of legal, financial and commercial due diligence. The extent and volume of due diligence does depend on the amount being invested. It is however important to try and identify swiftly potential areas of concern. So take a look in the mirror and be prepared with concise , executed documents, answers to their tough questions and don’t forget above all to impress upon them your unique selling features , experience and passion.

Areas of legal due diligence can be summarised as being able to respond and address the following key areas:

– do you have signed and suitable contracts with all members of staff employed or otherwise. These have suitable confidentiality clauses; protects the businesses intellectual property and holds suitable restrictive covenants?;

– do you have signed contracts or valid terms and conditions with all customers and also your suppliers?

– do you have an agreement regulating the founders, a shareholders agreement is essential for any business ?

– have all shares been properly allotted and transferred?

– have you filed everything at Companies House that should have been filed?

– has someone been promised something from the business , such as shares, which isn’t in writing or reflected at Companies House?

– is there any dispute or litigation or investigation or any risk of the same?

– who owns the intellectual property of the business and how can you prove this?

– have you got any consent or license or regulation you need to sell your product or service?

– have you got a commercial property? Have you got a commercial lease in place or agreement to use the space?

– have you considered Data Protection carefully ?

– have you registered and protected your IP?

This is just a taste of the legal questions and documents that could be requested from you , that should be carefully audited; updated and executed to protect the business

So often founders neglects to consider whether the potential investor is a good or suitable fit for the business. We would encourage all founders to carry out their own level of due diligence on any potential investor. By selling shares in your business to someone you are creating legal rights and obligations to that shareholder. With any business there are the inevitable hard times and difficult conversations. Having a suitable investor who is a good fit for your business makes those conversations a bit easier. It doesn’t dilute your obligation or legal duties not to unfairly prejudice them or act in breach of your fiduciary duties but it may make it a bit easier to address and remedy.

Do they understand your business or products ; could you ask them for assistance to scale or additional monies if necessary ; do they have the qualifications , experience or contacts they profess and what do they want from you?

There are many different types of investors and each fit different types and scales of businesses. Depending on the size and stage of the business this may be venture capital, private equity, angel investors, trade investors or friends and family.

Some of the due diligence you should be doing on any potential investor and questions you should be asking are:

– what are the investors exit plans? Are they aligned to yours?

– what is their and your expectations of a return?

– what other companies are in the investor’s portfolio

-what is the length of the fund?

– what is the impact or sector of the fund?

– how involved does the investor want to be?

– how experienced if the investor?

– do they benefit from EIS have you considered this ?

– what demands are they making ?

The documents you can expect to receive as part of an investment round is:

You may also receive updated service agreements (employment contracts) for the founders governing their role in the business and usually include provisions on payment and expectations on services.

The legal documents for an investment round can be intimidating, these are usually lengthy and typically contain complex terminology. What is vital, however, for any founder is to ensure that the documents work for them and fit their business. The agreements are worthless if they are unrealistic for the business.

A founder should familiarise themselves with each and every clause and be confident that they understand exactly what they are agreeing and the impact on them and the business.

Often , we are confronted by Investors, or their representatives trying to negotiate a provision as ‘standard’. Never forget that this is your business and you can always attempt to negotiate any and all terms and restrictions. Sometimes you never know the investor may be hiding behind something being ‘standard’ because they don’t know themselves what the clause is saying or the impact of the same.

It is often daunting to go through an investment round, there is new and complex terminology and it usually a stressful period as ultimately your business needs the funding to be able to continue. We understand this and work closely with founders taking on investment to ensure that they fully understand what they are agreeing and the impact on them and their business.

Analysis of this data reveals that women-led businesses are as likely as male-led businesses to receive the finance, so its not the unwillingness of VC’s to invest , but more a lower number of applications and pitches made or for a lower value.

UK VC & Female Founders report, commissioned by Chancellor Philip Hammond at Budget 2017 and undertaken by the British Business Bank in partnership found

One would hope things have changed , but data showed in 2020 of the £12bn of UK VC investment invested, companies with an all-female founder team would have received just £120.1m. Mixed-gender teams would have seen £1.and all-male counterparts, just shy of £10.7bn. This again though we fear if more about applications rather than decisions. A report on acceptance / rejection would be interesting but not easily put into context, but essentially female founders securing investment is increasing but still far apart from that taken up by all male founder businesses and the question should be why are there less female founders seeking investment ?

Are there less in general ? Do they prefer to self-fund and consider debt financing ? or Are they being rejected . Whatever the reason we need to encourage and support all businesses to scale up and become successful and particularly entice female founders into the investment ring.

About the author

About the authorHot shot solicitor Karen Holden launched A City Law Firm in 2009 after growing concerned about the impact pregnancy would have on her career at an international law firm.

The company are now the go-to legal experts for entrepreneurs and they have won several prestigious accolades including Most Innovative Law Firm of the Year 2016. Karen has also been shortlisted for Working Mums Champion this year by WorkingMums.

Karen’s drive to succeed stems from being raised on a tough council estate in Wales, where her her mum worked three jobs as a single parent. Desperate for a better life, Karen managed to secure a scholarship to study at Cambridge before qualifying as a solicitor.

November

06nov10:0015:00CPD Accredited Menopause Champion Course

06/11/2025 10:00 - 15:00(GMT+00:00)

Join us on our CPD Accredited Menopause Champion Course Our course includes practical tools, DEI considerations and step-by-step guidance to help Champions feel confident and equipped to offer real support — not just awareness. Here’s what’s included: Understanding Menopause

Our course includes practical tools, DEI considerations and step-by-step guidance to help Champions feel confident and equipped to offer real support — not just awareness.

Here’s what’s included:

Understanding Menopause

– Key stages and common symptoms

– How menopause impacts work and wellbeing

Diversity in Menopause

– Different experiences across cultures, health, age, and gender identity

Managing Menopause

– Overview of HRT, natural options, and practical strategies

Navigating GP Appointments

– How to self-advocate, track symptoms, and prepare for appointments

Supporting Colleagues

– Fostering openness, having sensitive conversations, and making adjustments

Creating Menopause Action Plans

– Step-by-step template to ensure support and inclusion

Championing Inclusion

– Guidance for supporting neurodivergent, disabled, diverse, LGBTQ+, and frontline staff

Your Role as a Champion

– Responsibilities, boundaries, signposting, and building trust

The course also includes:

✅ A Menopause Action Plan template

✅ Navigating GP Appointments document

Plus loads more free resources!

DATE: Thursday 6th November

DATE: Wednesday 17th December

Place: Zoom

Time: 10.0am – 3.00pm

Cost: £395 (including certificate)

19nov10:0013:00MenoMinds – Free Training for Women in Business | Menospace & Minds That Work

19/11/2025 10:00 - 13:00(GMT+00:00)

Introducing MenoMinds – Free Training for Women in Business We’re excited to share MenoMinds, a fully funded programme created by Menospace and

We’re excited to share MenoMinds, a fully funded programme created by Menospace and Minds That Work, supporting women in business, freelancing, or entrepreneurship through the emotional and mental challenges of menopause.

Wednesday 19th November | 10:00am – 1:00pm (UK)

Live on Zoom | 💷 Free (funded by NEBOSH’s Social Purpose Programme)

Menopause can affect confidence, focus and wellbeing — MenoMinds helps you take back control with practical tools and a supportive community.

You’ll explore the CARE Framework:

Includes a digital workbook and invitation to monthly community groups on sleep, nutrition and stress management.

Freelancers, entrepreneurs, and women in small or micro-businesses (under 50 employees).

Facilitators: Haley White (Menospace) and Victoria Brookbank (Minds That Work)

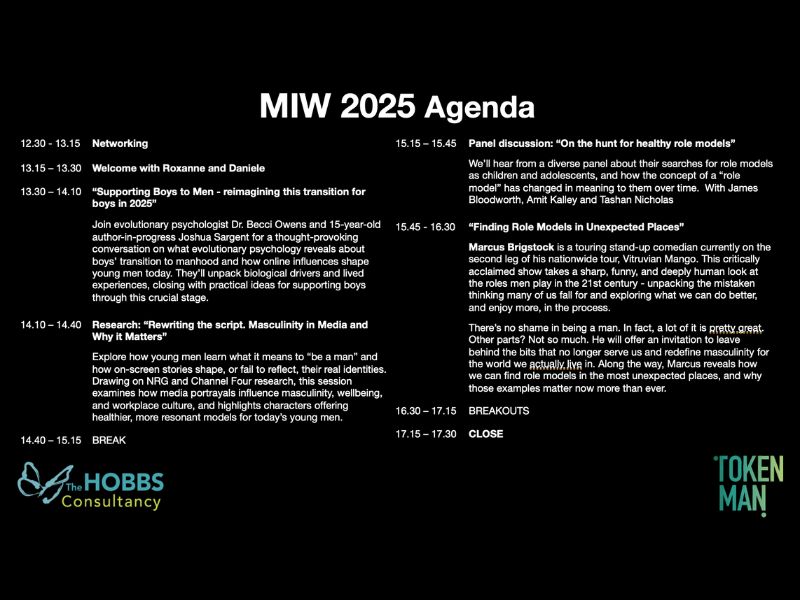

19nov12:3018:00Masculinity in the Workplace - 2025 (In-person)

19/11/2025 12:30 - 18:00(GMT+00:00)

Conway Hall

25 Red Lion Square, London, WC1R 4RL

Brought to you by Token Man and The Hobbs Consultancy. Welcome to Masculinity in the Workplace, designed specifically to

Welcome to Masculinity in the Workplace, designed specifically to engage men with creating inclusive cultures. Marking International Men’s Day, the objective of our event is to give men both the reason and the skills to lean into the conversation, while also providing women and non-binary people with the confidence to engage more men in culture change. Because ultimately we can only make real change by working together.

Date: Weds Nov 19 2025

Time: 12.30pm to 6pm

Location: Conway Hall, 25 Red Lion Square, London, WC1R 4RL

Our speakers will share their insights and experiences, shedding light on the evolving dynamics of masculinity, leadership and culturein diverse work environments. You’ll have the chance to ask questions, participate in interactive sessions, and network with like-minded professionals.

The theme for this year is ‘Supporting Boys to Men to Role Models’. This year’s event will seek to understand the concerns and barriers that are in the way for boys and men, particularly looking at key inflection points in their lives. It will equip parents, leaders, friends and persons of significance in the lives of young men with the tools for self-reflection, effective role modelling and courageous conversations..

It will suggest that status-seeking and risk-taking behaviours are innate as boys become men, look at how this shows up for boys in 2025 and question what support could help these boys have a more positive initiation in to adulthood so that they are ready for the workplace. We know that there is a reverse gender pay gap and that schools aren’t preparing students in the same way to enter the professional workplace – what needs to be done?

We will look at the behaviours that are role modelled by men once they are in the workplace. Is it healthy for us to look for male role models, or is a search for positive behaviours more effective? What can we learn from how men are represented on screen and in the media? And what can we do to support our men once they are in the workplace?

This site is for the in-person experience. Otherwise you can register for the online version here.

FYI – lunch will not be provided

This event is for anyone passionate about creating more inclusive, equitable, diverse and human workplaces, and we welcome attendees of all identities and expressions.

Historically, our audience has included around 60% men and 40% women or non-binary people, with a wide range of roles and lived experiences.

This year, we’re especially keen to welcome CEOs, HRDs, CMOs, Inclusion & Diversity leaders, People & Culture teams, and anyone working to engage men more effectively in their organisations. Whether you’re a parent, people manager, or someone invested in systemic culture change, this event is for you.

By attending, you’ll be joining a growing community of people committed to reshaping masculinity, unlocking allyship, and building workplace cultures where everyone can thrive – from boys and young men to senior leaders and everyone in between.

20novAll DayDigital Transformation Conference

20/11/2025 All Day(GMT+00:00)

Mercure London Earls Court

London

Ready to transform your business in the digital age? The upcoming Digital Transformation Conference UK promises an exceptional opportunity for leaders who want to accelerate change, embrace innovation and shape

Explore how industry leaders are redefining digital and business transformation. Learn proven strategies, gain fresh perspectives, and connect with peers shaping the future of technology and enterprise. Tactical & practical content to drive your transformation efforts.

Throughout the day, delegates can look forward to a diverse programme of content exploring every aspect of digital transformation, business change, and innovation. Hear best practices, lessons learned, and insights into real-world challenges from leaders driving progress across digital, technology and IT.

If you’re a C-suite leader, head of innovation, transformation or IT, this is the place to be. Whether you’re just starting your journey or looking to scale up, you’ll leave with fresh ideas, new contacts and a renewed sense of direction.