Article by Chieu Cao, CEO, Mintago

2021 has been another hard year for UK businesses. Challenges continue to mount on all sides in a landscape that is as unpredictable as it is unforgiving.

2021 has been another hard year for UK businesses. Challenges continue to mount on all sides in a landscape that is as unpredictable as it is unforgiving.The pandemic has defined the past 20 months; some businesses have struggled to adapt to shifting working conditions, others have been affected by unforeseen complications and delays, and the constant threat of infections has impacted the mental and physical wellbeing of employees.

In the light of such difficult conditions, SMEs have needed to be particularly prudent in their financial management. Positively, the Government offered financial support through its Job Retention furlough program and the Coronavirus Business interruption Loan Scheme (CBILS), but the onus remains on decision-makers to navigate these testing times.

Now, with another variant on the rise, the Government re-introducing restrictions, and rising consumer and rental prices necessitating salary increases, employers face fresh concerns. And again, keeping control of a business’ finances is absolutely crucial. To that end, one option to consider in 2022 is the HMRC’s salary sacrifice pension scheme.

As the name suggests, the salary sacrifice pension scheme involves employees agreeing to put up a small part of their salary in exchange for an equivalent pension contribution from their employers. In signing up to this scheme, employers can actually lower their National Insurance (NI) tax bill as these contributions are an allowable expense for organisations and are therefore not eligible for NI. Just by signing up to this program, businesses can save money while paying more into their workers’ pension pots.

This is not only beneficial for the employers, however; while employees nominally agree to sacrifice a portion of their total salary, this is then more than made up for in tax and NI savings, actually resulting in an increase in take-home pay. In short, employees take home more and businesses can save money while they do it.

In a time of such great uncertainty, where fine margins can be the difference between a business surviving and disappearing, this scheme cannot be overlooked.

Explained in these terms, the salary sacrifice pension scheme sounds like a deal too good to turn down. And yet, a recent YouGov poll of British businesses revealed that only 50% of SMEs are currently signed up to the scheme, compared to a rate of 86% among FTSE 350 companies. What is keeping smaller businesses from joining the scheme?

The most common reason is likely a simple lack of awareness; that same YouGov survey found that 17% of businesses had never even heard of the scheme. The issue here is a lack of information, as the benefits are so great that any decision-maker worth their salt would have to consider it, but evidently many have not.

Lack of awareness is not the only obstacle; 14% of those not using the scheme said that they consider it to be too much of a hassle. The prospect of upending their existing pension structures and instilling a new system is understandably daunting for smaller outfits. But if they do not act,they will likely miss out on significant savings. In reality, the switch to salary sacrifice pension is relatively simple, and there are partners that can assist in the process.

More needs to be done to spread the word about the salary sacrifice scheme – with a 1.25% national insurance tax hike inbound this April, and no end in sight to the climate of uncertainty we inhabit, ignorance is not an excuse. The Government is extending a helping hand through this scheme, but needs to do more to publicise and promote it. Business leaders need to also consider the potential savings on offer and protect themselves and their employees for the future.

As 2022 approaches and businesses of all sizes prepare their financial plans for the new year, business leaders should make the salary sacrifice pension scheme a top priority.

About the author

About the authorChieu Cao is CEO of Mintago. Mintago is an FCA regulated company that helps businesses and employees save money via HMRC’s salary sacrifice pension scheme. Mintago provides a salary sacrifice pension hassle-free implementation program which creates direct savings on monthly (National Insurance) NI payments, with a platform that simplifies managing employee pension contributions. Mintago’s platform also helps find lost pensions quickly and provides financial planning tools, supported by over 1,000 pieces of informative content and tips about various aspects of their personal finances for employees.

November

19nov10:0013:00MenoMinds – Free Training for Women in Business | Menospace & Minds That Work

19/11/2025 10:00 - 13:00(GMT+00:00)

Introducing MenoMinds – Free Training for Women in Business We’re excited to share MenoMinds, a fully funded programme created by Menospace and

We’re excited to share MenoMinds, a fully funded programme created by Menospace and Minds That Work, supporting women in business, freelancing, or entrepreneurship through the emotional and mental challenges of menopause.

Wednesday 19th November | 10:00am – 1:00pm (UK)

Live on Zoom | 💷 Free (funded by NEBOSH’s Social Purpose Programme)

Menopause can affect confidence, focus and wellbeing — MenoMinds helps you take back control with practical tools and a supportive community.

You’ll explore the CARE Framework:

Includes a digital workbook and invitation to monthly community groups on sleep, nutrition and stress management.

Freelancers, entrepreneurs, and women in small or micro-businesses (under 50 employees).

Facilitators: Haley White (Menospace) and Victoria Brookbank (Minds That Work)

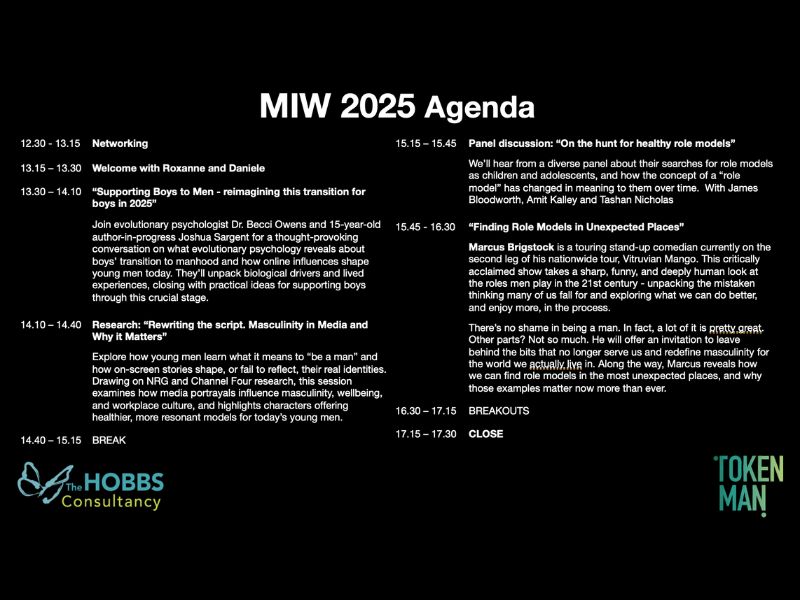

19nov12:3018:00Masculinity in the Workplace - 2025 (Hybrid)

19/11/2025 12:30 - 18:00(GMT+00:00)

Conway Hall

25 Red Lion Square, London, WC1R 4RL

Brought to you by Token Man and The Hobbs Consultancy. Welcome to Masculinity in the Workplace, designed specifically to

Welcome to Masculinity in the Workplace, designed specifically to engage men with creating inclusive cultures. Marking International Men’s Day, the objective of our event is to give men both the reason and the skills to lean into the conversation, while also providing women and non-binary people with the confidence to engage more men in culture change. Because ultimately we can only make real change by working together.

Date: Weds Nov 19 2025

Time: 12.30pm to 6pm

Location: Conway Hall, 25 Red Lion Square, London, WC1R 4RL

Our speakers will share their insights and experiences, shedding light on the evolving dynamics of masculinity, leadership and culturein diverse work environments. You’ll have the chance to ask questions, participate in interactive sessions, and network with like-minded professionals.

The theme for this year is ‘Supporting Boys to Men to Role Models’. This year’s event will seek to understand the concerns and barriers that are in the way for boys and men, particularly looking at key inflection points in their lives. It will equip parents, leaders, friends and persons of significance in the lives of young men with the tools for self-reflection, effective role modelling and courageous conversations..

It will suggest that status-seeking and risk-taking behaviours are innate as boys become men, look at how this shows up for boys in 2025 and question what support could help these boys have a more positive initiation in to adulthood so that they are ready for the workplace. We know that there is a reverse gender pay gap and that schools aren’t preparing students in the same way to enter the professional workplace – what needs to be done?

We will look at the behaviours that are role modelled by men once they are in the workplace. Is it healthy for us to look for male role models, or is a search for positive behaviours more effective? What can we learn from how men are represented on screen and in the media? And what can we do to support our men once they are in the workplace?

This site is for the in-person experience. Otherwise you can register for the online version here.

FYI – lunch will not be provided

This event is for anyone passionate about creating more inclusive, equitable, diverse and human workplaces, and we welcome attendees of all identities and expressions.

Historically, our audience has included around 60% men and 40% women or non-binary people, with a wide range of roles and lived experiences.

This year, we’re especially keen to welcome CEOs, HRDs, CMOs, Inclusion & Diversity leaders, People & Culture teams, and anyone working to engage men more effectively in their organisations. Whether you’re a parent, people manager, or someone invested in systemic culture change, this event is for you.

By attending, you’ll be joining a growing community of people committed to reshaping masculinity, unlocking allyship, and building workplace cultures where everyone can thrive – from boys and young men to senior leaders and everyone in between.

Receive a 50% discount on an in person and virtual ticket below.

20novAll DayDigital Transformation Conference

20/11/2025 All Day(GMT+00:00)

Mercure London Earls Court

London

Ready to transform your business in the digital age? The upcoming Digital Transformation Conference UK promises an exceptional opportunity for leaders who want to accelerate change, embrace innovation and shape

Explore how industry leaders are redefining digital and business transformation. Learn proven strategies, gain fresh perspectives, and connect with peers shaping the future of technology and enterprise. Tactical & practical content to drive your transformation efforts.

Throughout the day, delegates can look forward to a diverse programme of content exploring every aspect of digital transformation, business change, and innovation. Hear best practices, lessons learned, and insights into real-world challenges from leaders driving progress across digital, technology and IT.

If you’re a C-suite leader, head of innovation, transformation or IT, this is the place to be. Whether you’re just starting your journey or looking to scale up, you’ll leave with fresh ideas, new contacts and a renewed sense of direction.