With 2022 just beginning, it is an opportune time to review finances, plan for the future and take steps to manage your money in the most economically effective way.

Naturally, Christmas and a new year encourages optimism, but it is sensible to be prepared for what fate could throw at you. When times are good, there is a reluctance to consider potential worst-case scenarios.

Everyone has mortgage protection, for example, but income protection is often overlooked. It is vital that critical illness cover is in place to guard against the ‘what ifs’ of life. Serious illness is traumatic in itself, but it is magnified if you then have to cope with the financial implications of having to stop work, either temporarily or permanently. A one-off, tax- free payment will help pay for treatments, mortgages, rents and any necessary adaptations to the home, such as wheelchair accessibility.

An emergency fund is equally vital, as the Covid-19 pandemic so recently proved when many found themselves having to access – and sometimes empty – their funds. The ramifications of being unable to make a repayment can snowball rapidly. Faced with such a possibility, it is recommended that you set aside enough money to cover at least three months of expenditure. This will afford you valuable breathing space to make new arrangements.

When it comes to investing, everyone will have their own attitude towards risk, which will typically be linked, intrinsically, to their demographic, personal circumstances and personality.

If you’re looking for low-risk investments then the highs won’t be as high, but the lows won’t be as low. There is a degree more certainty but there is no guarantee. The main question to ask yourself is do you want your money just sitting in an account earning zero interest for another year when it could be working hard for you? This is particularly relevant as inflation continues to increase and cash is effectively being eroded in value.

Mindsets towards social and environmental impact are evolving year-on-year and if one of your resolutions is to make a positive contribution to the world around us, then ESG (Environmental, Social, and Governance) investments can be a compelling option.

Some assume that ethical investments do not yield as good a financial return and that investing for the greater good brings an element of financial self-sacrifice, but that is not necessarily the case. ESG investments are performing well and the more successful companies have already embraced ESG as part of their corporate cultures.

For the more tentative or less experienced investor, pound cost averaging can offer a good introduction to stocks and shares. This strategy involves making regular, smaller investment contributions over a period of time, rather than investing one larger lump sum at the outset.

The rationale is that in volatile equity markets, where the value of investments can fluctuate considerably in the short term, ‘drip-feeding’ your cash offers a level of protection if the market falls shortly after you have invested.

A pension still remains the most tax efficient option for securing financial well-being. Adding to your pension whenever possible should be a priority as it increases the likelihood of achieving the retirement you desire, and you could receive tax relief on your additional contributions.

With the state pension currently providing an annual income of £9,339, adding one or multiple personal pension schemes has become an attractive and popular proposition. Selecting the appropriate personal pension can be confusing and it is advisable to seek advice from a financial adviser. Too often, those attempting to navigate the market alone are swayed by cost rather than performance.

The discrepancy in pension amounts between genders is something that you do not want to fall victim to in retirement. Recent figures reveal men, who have not yet retired, already have an average of £62,336 in their pension pot compared to women who average just £22,735. This has been partly attributed to married women who may, at some point in their career, reduce their working hours or take time out to care for young children, for example. During such periods, husbands should consider making contributions to their wives’ pensions to ensure pension parity in retirement which will enable them to spread the income across both of their income tax bands, potentially resulting in less income tax being paid.

When you receive child benefits you also receive National Insurance credits towards your state pension. If you don’t claim the child benefit then you may not be receiving these National Insurance credits which could result in a lower state pension entitlement and this is something that a lot of women don’t realise. In a scenario where the husband is earning a salary above the child benefit entitlement threshold, and the wife is working fewer hours, it might seem pointless to claim the benefit as the level of taxation on it could leave you no better off. But failing to do so can mean that your pension entitlement will suffer.

Married women should ultimately look to ensure they are involved in all financial planning decisions, rather than simply relying on the assets – including pension – of their spouse.

November

06nov10:0015:00CPD Accredited Menopause Champion Course

06/11/2025 10:00 - 15:00(GMT+00:00)

Join us on our CPD Accredited Menopause Champion Course Our course includes practical tools, DEI considerations and step-by-step guidance to help Champions feel confident and equipped to offer real support — not just awareness. Here’s what’s included: Understanding Menopause

Our course includes practical tools, DEI considerations and step-by-step guidance to help Champions feel confident and equipped to offer real support — not just awareness.

Here’s what’s included:

Understanding Menopause

– Key stages and common symptoms

– How menopause impacts work and wellbeing

Diversity in Menopause

– Different experiences across cultures, health, age, and gender identity

Managing Menopause

– Overview of HRT, natural options, and practical strategies

Navigating GP Appointments

– How to self-advocate, track symptoms, and prepare for appointments

Supporting Colleagues

– Fostering openness, having sensitive conversations, and making adjustments

Creating Menopause Action Plans

– Step-by-step template to ensure support and inclusion

Championing Inclusion

– Guidance for supporting neurodivergent, disabled, diverse, LGBTQ+, and frontline staff

Your Role as a Champion

– Responsibilities, boundaries, signposting, and building trust

The course also includes:

✅ A Menopause Action Plan template

✅ Navigating GP Appointments document

Plus loads more free resources!

DATE: Thursday 6th November

DATE: Wednesday 17th December

Place: Zoom

Time: 10.0am – 3.00pm

Cost: £395 (including certificate)

19nov10:0013:00MenoMinds – Free Training for Women in Business | Menospace & Minds That Work

19/11/2025 10:00 - 13:00(GMT+00:00)

Introducing MenoMinds – Free Training for Women in Business We’re excited to share MenoMinds, a fully funded programme created by Menospace and

We’re excited to share MenoMinds, a fully funded programme created by Menospace and Minds That Work, supporting women in business, freelancing, or entrepreneurship through the emotional and mental challenges of menopause.

Wednesday 19th November | 10:00am – 1:00pm (UK)

Live on Zoom | 💷 Free (funded by NEBOSH’s Social Purpose Programme)

Menopause can affect confidence, focus and wellbeing — MenoMinds helps you take back control with practical tools and a supportive community.

You’ll explore the CARE Framework:

Includes a digital workbook and invitation to monthly community groups on sleep, nutrition and stress management.

Freelancers, entrepreneurs, and women in small or micro-businesses (under 50 employees).

Facilitators: Haley White (Menospace) and Victoria Brookbank (Minds That Work)

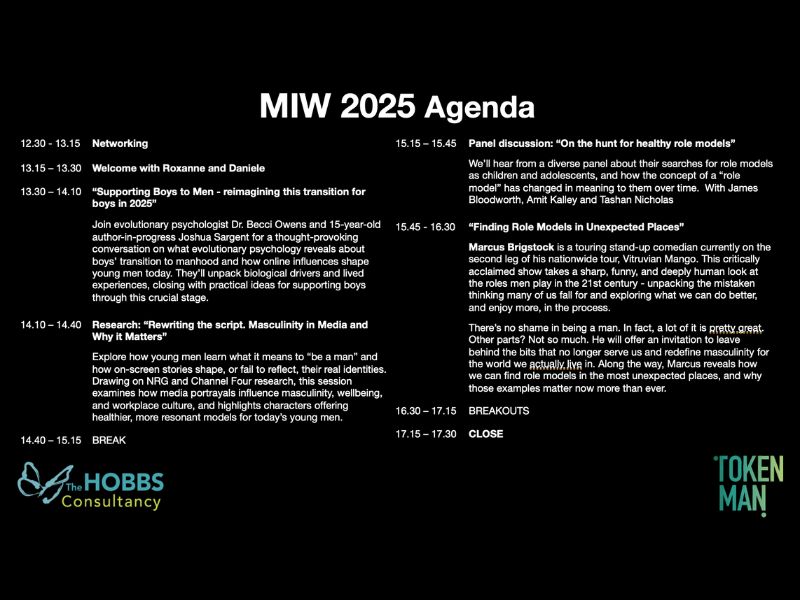

19nov12:3018:00Masculinity in the Workplace - 2025 (In-person)

19/11/2025 12:30 - 18:00(GMT+00:00)

Conway Hall

25 Red Lion Square, London, WC1R 4RL

Brought to you by Token Man and The Hobbs Consultancy. Welcome to Masculinity in the Workplace, designed specifically to

Welcome to Masculinity in the Workplace, designed specifically to engage men with creating inclusive cultures. Marking International Men’s Day, the objective of our event is to give men both the reason and the skills to lean into the conversation, while also providing women and non-binary people with the confidence to engage more men in culture change. Because ultimately we can only make real change by working together.

Date: Weds Nov 19 2025

Time: 12.30pm to 6pm

Location: Conway Hall, 25 Red Lion Square, London, WC1R 4RL

Our speakers will share their insights and experiences, shedding light on the evolving dynamics of masculinity, leadership and culturein diverse work environments. You’ll have the chance to ask questions, participate in interactive sessions, and network with like-minded professionals.

The theme for this year is ‘Supporting Boys to Men to Role Models’. This year’s event will seek to understand the concerns and barriers that are in the way for boys and men, particularly looking at key inflection points in their lives. It will equip parents, leaders, friends and persons of significance in the lives of young men with the tools for self-reflection, effective role modelling and courageous conversations..

It will suggest that status-seeking and risk-taking behaviours are innate as boys become men, look at how this shows up for boys in 2025 and question what support could help these boys have a more positive initiation in to adulthood so that they are ready for the workplace. We know that there is a reverse gender pay gap and that schools aren’t preparing students in the same way to enter the professional workplace – what needs to be done?

We will look at the behaviours that are role modelled by men once they are in the workplace. Is it healthy for us to look for male role models, or is a search for positive behaviours more effective? What can we learn from how men are represented on screen and in the media? And what can we do to support our men once they are in the workplace?

This site is for the in-person experience. Otherwise you can register for the online version here.

FYI – lunch will not be provided

This event is for anyone passionate about creating more inclusive, equitable, diverse and human workplaces, and we welcome attendees of all identities and expressions.

Historically, our audience has included around 60% men and 40% women or non-binary people, with a wide range of roles and lived experiences.

This year, we’re especially keen to welcome CEOs, HRDs, CMOs, Inclusion & Diversity leaders, People & Culture teams, and anyone working to engage men more effectively in their organisations. Whether you’re a parent, people manager, or someone invested in systemic culture change, this event is for you.

By attending, you’ll be joining a growing community of people committed to reshaping masculinity, unlocking allyship, and building workplace cultures where everyone can thrive – from boys and young men to senior leaders and everyone in between.

20novAll DayDigital Transformation Conference

20/11/2025 All Day(GMT+00:00)

Mercure London Earls Court

London

Ready to transform your business in the digital age? The upcoming Digital Transformation Conference UK promises an exceptional opportunity for leaders who want to accelerate change, embrace innovation and shape

Explore how industry leaders are redefining digital and business transformation. Learn proven strategies, gain fresh perspectives, and connect with peers shaping the future of technology and enterprise. Tactical & practical content to drive your transformation efforts.

Throughout the day, delegates can look forward to a diverse programme of content exploring every aspect of digital transformation, business change, and innovation. Hear best practices, lessons learned, and insights into real-world challenges from leaders driving progress across digital, technology and IT.

If you’re a C-suite leader, head of innovation, transformation or IT, this is the place to be. Whether you’re just starting your journey or looking to scale up, you’ll leave with fresh ideas, new contacts and a renewed sense of direction.